What is EA Form / Borang EA?

The Borang EA or the EA form is a yearly remuneration statement that every employee in the private sector will receive. The EA form contains information of an employee’s statutory contributions, wages, additional remunerations, additional deductions and current rebates.

Why are EA forms important?

EA forms are crucial for our personal income tax. When declaring our income tax, we can use the EA form as a reference to declare the correct amount of annual earnings and deduction. We can also use the EA form to check if we are above the pay grade that requires us to pay taxes.

EA forms are provided by the employer(company) to their employees. Employer’s have to prepare and issue the EA forms by the end of February every year. If an employer fails to comply with this deadline, they risk facing a fine of RM200-RM20,000 or imprisonment for a term of no longer than 6 months.

Employer Tax Obligation

What should I do if my company has hired a new staff?

You as the employing company must inform the LHDN nearest assessment branch about your new hire. This must be done within the first 30 days of new staff joining your company. Employer’s must do this using the CP22 form.

Failure to do so will result in a fine ranging from RM200 to RM2,000 or imprisonment for a term not exceeding six months.

What should I do if my employee retires of has been terminated?

It is the employer’s sole responsibility to inform IRBM within 30 days of the said employee’s cease date under these circumstances :

- Employee has retired

- Employee has left Malaysia permanently

- Employee is subjected to MTD scheme but employer has yet to make any deductions.

Failure to do so will result in a fine ranging from RM200 to RM2,000 or imprisonment for a term not exceeding six months.

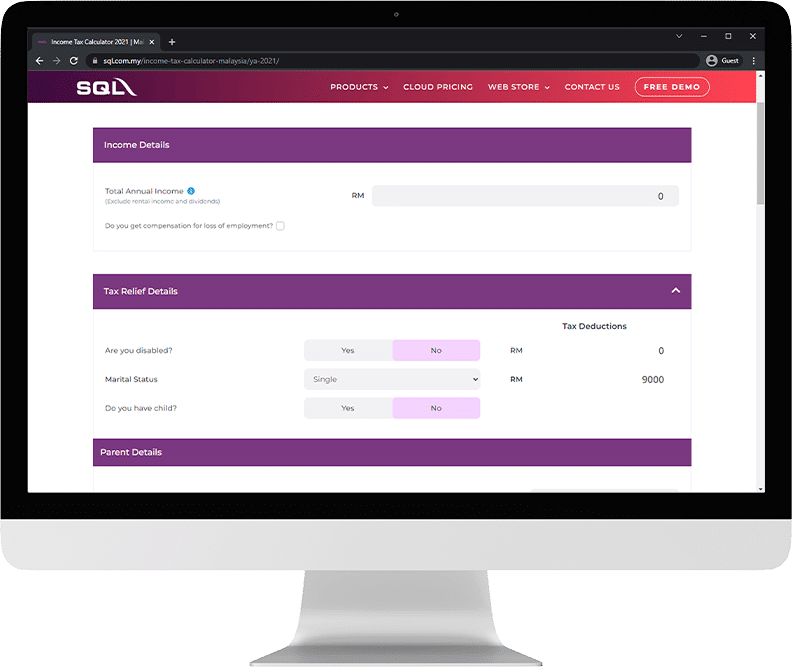

Estimate your tax with

Malaysia Best Income Tax Calculator & Planner

I just want tax payable RM 8000 only, how much yearly income do I need to report to LHDN? What is my tax bracket %?

SQL Professional Tax Planner comes with the highly popular, accountant favorite —

“ Tax Reversal Calculator ”.

Enter your desired tax payable amount and using the reverse calculator, our system will calculate the gross income in order to fulfil your expected tax bracket.

For example,

If you want your tax payable amount is RM 8000, what you need to do is insert RM 8000, and SQL tax calculator will calculate the yearly income to be reported to LHDN for you.

SQL Payroll Highlight Features

SQL Payroll Software removes the complexities in Human Resources Management, make your payroll process easier. SQL Payroll Software ready with all HR management, eLeave, PCB tax calculator, specific contribution assignment and automatic overtime calculation. SQL Payroll is the only software that you would ever need to use for your Payroll processing.

With Malaysia Government Subsidy, you can have a certified, highly accurate and trustworthy SQL Payroll Software at 50% of the original price now!

Offered in limited slots, first-come-first-served basis.